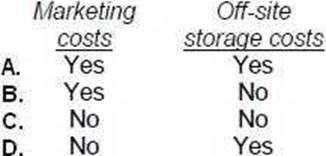

Under the uniform capitalization rules applicable to property acquired for resale, which of the following costs should be capitalized with respect to inventory if no exceptions are met?

Under the uniform capitalization rules applicable to property acquired for resale, which of the following costs should be capitalized with respect to inventory if no exceptions are met?

A . Option A

B. Option B

C. Option C

D. Option D

Answer: D

Explanation:

Choice "d" is correct. Under the uniform capitalization rules, purchasers of inventory for resale may deduct their marketing costs but must capitalize their off-site storage costs.

Choices "a", "b", and "c" are incorrect. Marketing costs are deductible, but off-site storage must be capitalized.

Latest CPA-Regulation Dumps Valid Version with 69 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments